Bollinger Bands Strategies (Part-8)

Friends…….

A lot of thanks for visit earnmoneyfx.com

As a series part strategy of Bollinger Bands Strategy, earnmoneyfx.com research team

suggests you to follow various type entry-exit strategies of Bollinger Bandsas below:

1. Candlesticks Pattern with Bollinger Bands

2. Double Top Chart Pattern with Bollinger Bands

3. Double Bottom Chart Pattern with Bollinger Bands

4. Reversal or Counter Candlesticks with Bollinger Bands

5. Trend line Breakout with Bollinger Bands

6. Swing Trading with Middle Bands (20 Simple Moving Average) Bollinger Bands

7. Walking with Bollinger Bands

8. Ascending Triangle with Bollinger Bands

9. Descending Triangle with Bollinger Bands

10. Symmetrical Triangle with Bollinger Bands

11. Flag Pattern with Bollinger Bands

12. Channel with Bollinger Bands

13. Candlesticks Pattern with Bollinger Bands

14. Golden Cross with Bollinger Bands

15. Death Cross with Bollinger Bands

16. Short term & Mid term moving average cross with Bollinger Bands

17. Multi time frame analysis with Bollinger Bands

18. 200 Simple Moving Average with Bollinger Bands etc.

Bollinger Bands Entry-Exit Strategy (Part -1) we have discussed about Candlesticks

Pattern with Bollinger Bands and Double Top Chart Pattern with Bollinger Bands

Above link is for your ready references.

Bollinger Brand Entry-Exit Strategy (Part -2) we have discussed about Double Bottom

Chart Pattern with Bollinger Bands and Reversal or Counter Candlesticks with

Bollinger Bands.

Above link is for your ready references.

Bollinger Brand Entry-Exit Strategy (Part -3) we have discussed about Trend line

Breakout with Bollinger Bands

Above link is for your ready references.

Bollinger Brand Entry-Exit Strategy (Part -4) we have discussed about Swing Trading with

Middle Bands (20 Simple Moving Average) Bollinger Bands

Above link is for your ready references.

Bollinger Brand Entry-Exit Strategy (Part -5) we have discussed about 200 Simple Moving

Average with Bollinger Bands

Above link is for your ready references.

Bollinger Bands Entry-Exit Strategy (Part -6) we have discussed about Walking with

Bollinger Bands.

Above link is for your ready references.

Bollinger Bands Entry-Exit Strategy (Part -7)

we have discussed about Ascending Triangle

with Bollinger Brand Entry-Exit Strategy, Descending Triangle with Bollinger Bands

Entry-Exit Strategy and Symmetrical Triangle with Bollinger Bands Entry-Exit

Strategy.

Above link is for your ready references.

If you missed all or anyone, Earnest request you to visit Bollinger Bands Entry-Exit

Strategy (Part -1), Bollinger Bands Entry-Exit Strategy (Part -2), Bollinger Brand Entry-Exit

Strategy (Part -3), Bollinger Bands Entry-Exit Strategy (Part -4), Bollinger Bands Entry-Exit

Strategy (Part -5), Bollinger Bands Entry-Exit Strategy (Part -6) and Bollinger Bands Entry

Exit Strategy (Part -7) in earnmoneyfx.com

These article earnmoneyfx.com research teams try to cover another strategy as below.

*** Flag pattern with Bollinger Bands Entry-Exit Strategy ***

*** Channel with Bollinger Bands Entry-Exit Strategy ***

As per earnmonreyfx.com research team demo test, this strategy works well any

timeframe and any pair.

For good success rate we suggest you One Hourly, Four Hourly, Daily timeframe and major

pair (EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCHF, USDCAD, USDJPY, EURJPY,

GBPJPY), XAUUSD, XAUEUR, CRUIDE OIL and S&P500

Let’s explore all ……….

For your soft reminder, Before enter deep discussion about Bollinger Bands strategy, its

important us to know what is Bollinger Bands and How to calculate Bollinger Bands

What is Bollinger Bands?

Bollinger Bands was developed by John Bollinger. Bollinger Bands® is a registered

trademark by John Bollinger.

Bollinger Bands is very simple. It has three parts. Upper Bands, Middle Bands and Lower

Bands.

Upper Bands and Lower Bands are volatility based Bands. Volatility based on standard

deviation. By using standard deviation volatility increase and decrease. Usually standard

deviation 2 set in upper Bands and lower Bands.

When volatility increases the band automatically widen and when volatility decreases the

band automatically contract.

Middle Bands is 20 Simple Moving Average. Simple Moving Average use the standard

deviation formula thus 20 Simple Moving Average use Bollinger Bands as a middle brand.

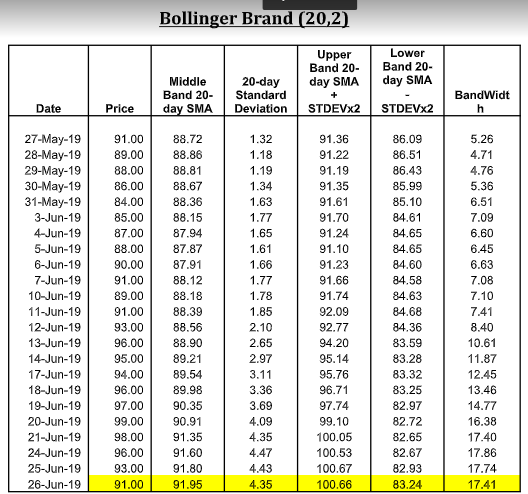

Calculation of Bollinger Bands:

* Middle Band = 20-day simple moving average (SMA)

* Upper Band = 20-day SMA + (20-day standard deviation of price x 2)

Please note, Bollinger Bands (20,2) is build in setup by Jhon Bollinger. But its not

mandatory to setup by build. You can change as your choice. But one thing you have to

know that most of trader setup Bollinger Brand as a build in thus its show buy or signal

similarly most of trader. If you want to change build in setup, at first you have to specialists

in Bollinger Bands strategies. Otherwise more chance to hit stop loss. It will be best if you

with crowd.

As per John Bollinger suggestion,

You can set standard deviation multiplier 2, where simple moving average is 20 and

standard deviation value is 20.

You can set standard deviation multiplier 2.1, where simple moving average is 50 and

standard deviation value is 50.

You can set standard deviation multiplier 1.9, where simple moving average is 10 and

standard deviation value is 10.

How to set up Bollinger Bands in Metatrader4:

Open Metatrader4 > Insert > Indicator > Trend > Bollinger Bands

Let’s explore ……….

Flag pattern with Bollinger Bands Entry-Exit Strategy:

Before explore Flag pattern with Bollinger Bands Entry-Exit Strategy at first we learn to

know what Ascending Triangle is.

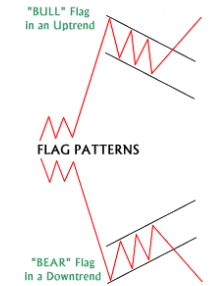

What is Flag Pattern: The Flag Pattern is actually continuation pattern. Basically Flag

Pattern find out in chart after massive or big bullish or bearish movement. Research has

shown that Flag Pattern is some of the most reliable continuation pattern.

As above image of Flag Pattern we found below things.

Bullish Flag maintain lower tops and lower bottoms. Also the pattern goes against up

trend but the channel go ahead with parallel.

Bearish Flag maintain higher tops and higher bottoms. Also the pattern goes against

down trend but the channel go ahead with parallel.

Minimum two lower tops and two lower bottoms required for create bullish flag

pattern .

Minimum two higher tops and two higher bottoms required for create bearish

flag pattern .

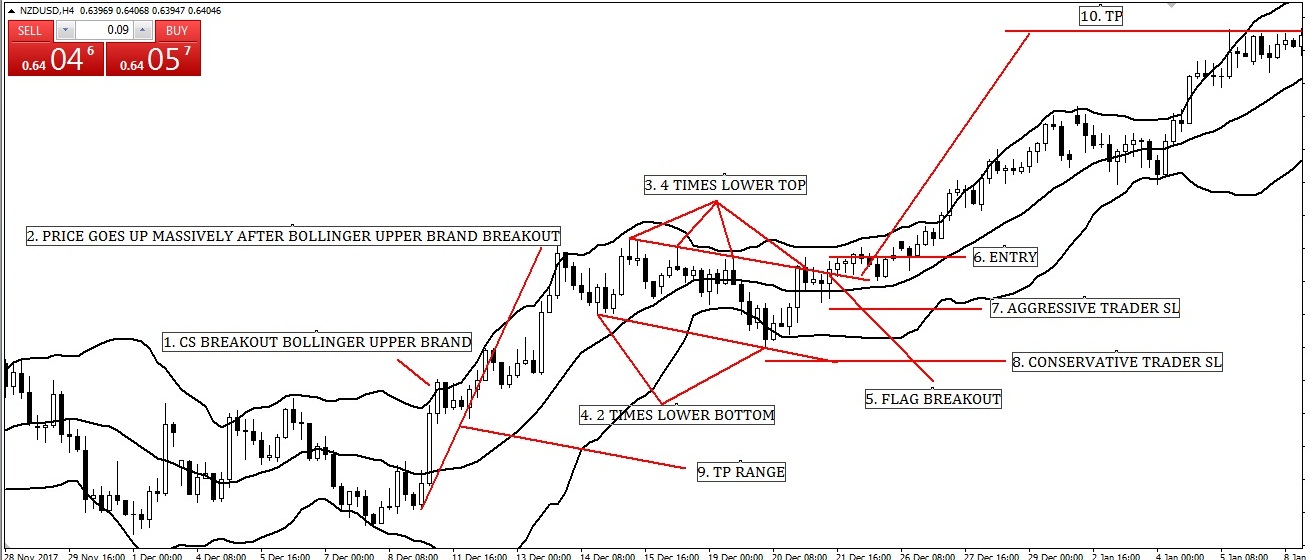

Image 1:

Bullish Flag Pattern with Bollinger Bands Entry-Exit Strategy

Image point number – 1, We see candlesticks breakout Bollinger Upper Bands. That

means its uptrend. Also its time to wait and watch as per Bullish Flag Pattern with Bollinger

Bands Entry-Exit Strategy rules.

Image point number – 2, Strong uptrend created where price goes up massively.

Image point number – 3, After strong uptrend price gone to correction. Price created four

times lower tops but failure to breakout.

Image point number – 4, Price created two times lower bottom. We concretely found

bullish flag pattern in chart. Now we have to wait for breakout.

Image point number – 5, At last price breakout bullish flag pattern. As per Bullish Flag

Pattern with Bollinger Bands Entry-Exit Strategy rules its time to buy. But we have to wait

for candlesticks close above channel. which indicate successful. breakout.

Image point number – 6, Aggressive or conservative trader put their BUY STOP order 2

pips above of Bullish Flag Pattern breakout candlesticks.

Image point number – 7, After hit BUY STOP order aggressive trader place STOP LOSS 2

pips below of Bullish Flag Pattern breakout candlesticks.

Image point number – 8, Conservative traders place STOP LOSS 2 pips below of Bullish

Flag Pattern lower channel.

Image point number – 9, As per Bullish Flag Pattern exit rules, we measure take profit

range.

Image point number – 10, Conservative or aggressive trader place their take profit level

on Bullish Flag Pattern take profit range or near swing high or 1 : 2 or 1 : 3 risk reward

ratio.

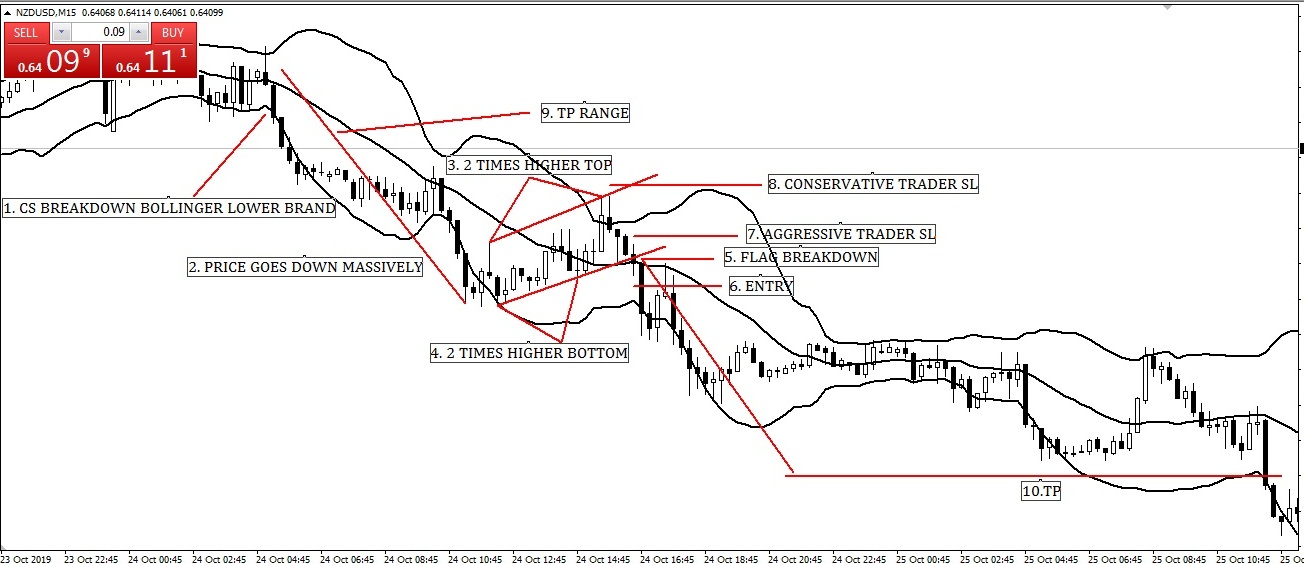

Image 2:

Bearish Flag Pattern with Bollinger Bands Entry-Exit Strategy

Image point number – 1, We see candlesticks break down Lower Bands of Bollinger. That

means its down trend. Also its time to wait and watch as per Bearish Flag Pattern with

Bollinger Bands Entry-Exit Strategy rules.

Image point number – 2, Strong down trend created where price goes down massively.

Image point number – 3, After strong down trend price gone to reversal. Price created

two times higher top.

Image point number – 4, Price created two times higher bottom. We concretely found

bullish flag pattern in chart. Now we have to wait for break down.

Image point number – 5, At last price break down bearish flag pattern. As per Bearish

Flag Pattern with Bollinger Brand Entry Exit Strategy rules its time to sell. But we have to

wait for candlesticks close below channel which indicate successful break down.

Image point number – 6, Aggressive or conservative trader put their SELL STOP order 2

pips below of Bearish Flag Pattern break down candlesticks.

Image point number – 7, After hit SELL STOP order aggressive trader place STOP LOSS 2

pips above of Bearish Flag Pattern break down candlesticks.

Image point number – 8, Conservative traders place STOP LOSS 2 pips above of Bearish

Flag Pattern lower channel.

Image point number – 9, As per Bearish Flag Pattern exit rules, we measure take profit

range.

Image point number – 10, Conservative or aggressive trader place their take profit level

on Bearish Flag Pattern take profit range or near swing high or 1 : 2 or 1 : 3 risk reward

ratio.

Channel pattern with Bollinger Bands Entry-Exit Strategy:

Before explore Channel pattern with Bollinger Bands Entry-Exit Strategy at first we

learn to know what is Channel pattern.

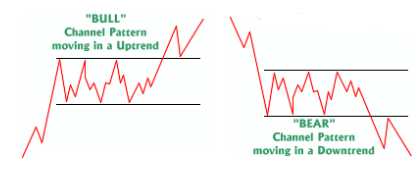

What is Channel Pattern: Channel Pattern is actually continuation. pattern. It’s also

indecision. area. Basically Channel Pattern find. out in chart after massive or big bullish or

bearish movement. Research has shown that Channel Pattern is some of the most reliable

continuation patterns Of course. trend lines run parallel. Supply and demand seems

balanced at the moment. Buyers and sellers also seem equally.

As above image of Channel Pattern we found below things.

Bullish channel maintain parallel tops and parallel bottoms. Also the pattern goes

against up trend but the channel goes ahead with parallel.

Bearish channel maintain parallel tops and parallel bottoms. Also the pattern goes

against down trend but the channel goes ahead with parallel.

Minimum two parallel tops and two parallel bottoms required for create bullish

channel pattern.

Minimum two parallel tops and two parallel bottoms required for create bearish

channel pattern.

Image 3:

Bullish Channel Pattern with Bollinger Bands Entry-Exit Strategy

Image point number – 1, We see candlesticks sideways. Also its time to wait and watch as

per Bullish channel Pattern with Bollinger Brand Entry-Exit Strategy rules.

Image point number – 2, Strong uptrend created where price goes up massively.

Image point number – 3, After strong uptrend price gone to correction. Price created two

times equal tops but failure to breakout.

Image point number – 4, Price created two times equal bottom. We concretely found

bullish channel pattern in chart. Now we have to wait for breakout.

Image point number – 5, At last price breakout bullish channel pattern. As per Bullish

channel Pattern with Bollinger Brand Entry-Exit Strategy rules its time to buy. But we have

to wait for candlesticks close above channel. which indicate successful. breakout.

Image point number – 6, Aggressive or conservative trader put their BUY STOP order 2

pips above of Bullish channel Pattern breakout candlesticks.

Image point number – 7, After hit BUY STOP order aggressive trader place STOP LOSS 2

pips below of Bullish channel Pattern breakout candlesticks.

Image point number – 8, Conservative traders place STOP LOSS 2 pips below of Bullish

channel Pattern lower channel.

Image point number – 9, As per Bullish channel Pattern exit rules, we measure take profit

range.

Image point number – 10, Conservative or aggressive trader place their take profit level

on Bullish channel Pattern take profit range or near swing high or 1 : 2 or 1 : 3 risk reward

ratio.

Image 4:

Bearish channel Pattern with Bollinger Bands Entry-Exit Strategy

Image point number – 1, We see candlesticks are sideways. Its time to wait and watch as

per Bearish channel Pattern with Bollinger Brand Entry-Exit Strategy rules.

Image point number – 2, Strong down trend created where price goes down massively.

Image point number – 3, After strong down trend price gone to reversal. Price created

two times parallel top.

Image point number – 4, Price created two times parallel bottom. We concretely found

bullish flag pattern in chart. Now we have to wait for break down.

Image point number – 5, At last price break down bearish channel pattern. As per Bearish

channel Pattern with Bollinger Brand Entry Exit Strategy rules its time to sell. But we have

to wait for candlesticks close below channel which indicate successful break down.

Image point number – 6, Aggressive or conservative trader put their SELL STOP order 2

pips below of Bearish channel Pattern break down candlesticks.

Image point number – 7, After hit SELL STOP order aggressive trader place STOP LOSS 2

pips above of Bearish channel Pattern break down candlesticks.

Image point number – 8, Conservative traders place STOP LOSS 2 pips above of Bearish

channel Pattern lower channel.

Image point number – 9, As per Bearish channel Pattern exit rules, we measure take

profit range.

Image point number – 10, Conservative or aggressive trader place their take profit level

on Bearish channel Pattern take profit range or near swing high or 1 : 2 or 1 : 3 risk reward

ratio.

——- Thanks for give your valuable time to read this article ——–

(To be continued)

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience