200 Moving Average Strategies. (Part -6)

Friends……….

A lot of thanks for visit earnmoneyfx.com

As a series part strategy of 200 Moving Average Strategy, earnmoneyfx.com research

the team suggests you follow various type entry-exit strategies of 200 Simple Moving

Average as below:

1. Support & Resistance

2. 200 MA Bounce

3. Trend line

4. Ascending Triangle

5. Descending Triangle

6. Symmetrical Triangle

7. Flag Pattern

8. Channel

9. Candlesticks Pattern

10. Golden Cross

11. Death Cross

12. Short term & Midterm moving average cross

13. Multi-time frame analysis.

Please note all the above strategies are demo tested by the earnmoneyfx.com research team

which success ratio was sixty to seventy-five percent. If you follow our directions as

accurately when entry and exit, we sure that your trading result must better day by day.

200 Moving Average Strategy (Part -1) we have discussed about the structure of 200 Moving

Average, types of 200 Moving Average and 200 Moving Average Support and

Resistance Entry-Exit Strategy in detail.

The above link is for your ready references.

200 Moving Average Strategy (Part -2), we have discussed 200 Moving Average

Bounce Entry-Exit Strategy in details

200 Moving Average Strategy (Part -3), we have discussed How to Entry and Exit

Trend line and 200 Moving Average.

200 Moving Average Strategy (Part -4), we have discussed Ascending Triangle

with 200 Moving Average Entry-Exit Strategy, Descending Triangle with 200 Moving

Average Entry-Exit Strategy and Symmetrical Triangle with 200 Moving Average

Entry-Exit Strategy.

200 Moving Average Strategy (Part -5), we have discussed about Bullish flag pattern

with 200 Moving Average Entry-Exit Strategy, Bearish flag pattern with 200 Moving

Average Entry-Exit Strategy, Bullish Channel Pattern with 200 Moving Average Entry

Exit Strategy, Bearish Channel Pattern with 200 Moving Average Entry-Exit Strategy

If you missed all or anyone, Earnest request you to visit 200 Moving Average Strategy (Part

-1), 200 Moving Average Strategy (Part -2), 200 Moving Average Strategy (Part -3), 200

Moving Average Strategy (Part -4) and 200 Moving Average Strategy (Part -5) in

earnmoneyfx.com

This article earnmoneyfx.com research teams try to cover another strategy as below.

*** Golden Cross Entry-Exit Strategy ***

*** Golden Cross Entry-Exit Strategy ***

Let’s explore all ……….

Golden cross and Death cross are actually crossing above and below of two moving

averages. Before deep drive in Golden cross and Death cross first, we have to know what

Moving Averages is and how Moving averages are structured, Let’s check below …..

Moving Averages are of various types. E.g. Simple Moving Average (SMA), Exponential Moving

Average (EMA), Smoothed Moving Average (SMMA), etc.

Simple Moving Average (SMA) and Exponential Moving Average (EMA) are the most, uses of

this strategy because of its easy to calculate and understand.

As per the earnmonreyfx.com research team demo test, this strategy works well any

timeframe and any pair.

For good success rate, we suggest you One Hourly, Four Hourly, Daily timeframe and major

pair (EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCHF, USDCAD, USDJPY, EURJPY, GBPJPY),

XAUUSD, XAUEUR, CRUIDE OIL and S&P500

Definition and Calculation of Simple Moving Average (SMA):

A simple moving average is formed by calculating the average price of a currency

over a specific number of periods.

Most moving averages are based on closing prices; for example, a 5-day simple moving

average is the five-day sum of closing prices divided by five.

As its name implies, a moving average is an average that moves.

Old data is dropped as new data becomes available, causing the average to move along the

time scale.

The example below shows a 5-day moving average evolving over three days.

Daily Closing Prices: 11,12,13,14,15,16,17

First day of 5-day SMA: (11 + 12 + 13 + 14 + 15) / 5 = 13

Second day of 5-day SMA: (12 + 13 + 14 + 15 + 16) / 5 = 14

The first day of the moving average simply covers the last five days.

The second day of the moving average drops the first data point (11) and adds the new

data point (16).

The third day of the moving average continues by dropping the first data point (12) and

adding the new data point (17).

In the example above, prices gradually increase from 11 to 17 over a total of seven days.

Notice that the moving average also rises from 13 to 15 over a three-day calculation period.

Also, notice that each moving average value is just below the list price. For example, the

moving average for day one equals 13 and the last price is 15. Prices the prior four days

were lower and this causes the moving average to lag.

For your kind information, Any moving average strategy is a trend trading system.

Moving Averages works well when prices are uptrend or downtrend.

In a choppy or sideways market moving average strategies are unable to well.

So we always avoid using moving average strategies when markets are choppy or

sideways.

Otherwise, it chance to hit stop loss more and more.

Simple Moving Average is the default, indicator in Metatrader4 or Metatrader5.

Metatrader4 Simple Moving Average plot as below

Open Metatrader4 > Insert > Indicator > Trend > Moving Average > Simple > OK

Important things,

We will take our BUY decision when the price is above 200 Simple Moving Average.

Also, We will take our SELL decision when the price is below 200 Simple Moving Average.

What is Exponential Moving Average (EMA)?

An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight

and significance on the most recent data points.

The exponential moving average is also referred to as the exponentially weighted moving

average.

An exponentially weighted moving average reacts more significantly to recent price

changes than a simple moving average (SMA), which applies an equal weight to all

observations in the period.

Shortcut calculation of Exponential Moving Average (EMA):

Exponential Moving Average (EMA) = Price (T) X K + EMA (Y) X (1-k)

Where,

T= Today

Y= Yesterday

N= Number of Day in Exponential Moving Average

K= 2 / (N+1)

Don’t worry about the Exponential Moving Average critical calculation.

Exponential Moving Average is the default indicator in Metatrader4 or Metatrader5.

Metatrader4 Exponential Moving Average plot as below

Open Metatrader4 > Insert > Indicator > Trend > Moving Average> Exponential > OK

Important things,

We will take our BUY decision when the price is above 200 Exponential Moving Average.

Also, we will take our SELL decision when the price is below 200 Exponential Moving Average.

Golden Cross Entry-Exit Strategy:

Before exploring Golden Cross Entry-Exit Strategy at first we learn to know what is Golden

Cross.

What is Golden Cross: Few time, world heavyweight news channels or newspapers (e.g. BBC,

CNN and BLOOMBERG) published breaking news that EURUSD created Golden Cross. After

this news market tries to create new highs and highs. It’s specially BUY mood because of

Golden Cross.

Actually when Midterm Moving Average crosses Long Term Moving Averages from below

then, market, create Golden, Cross.

As very much simple, When 50 Simple Moving Average crosses 200 Simple Moving Average

from below its Golden Cross. You also can use Exponential Moving Average here.

Golden Cross ( 50 Simple Moving Average crosses 200 Simple Moving

Average from below)

Various types, Golden Cross Entry and Exit Strategy are practiced in financial, market

Earnmoneyfx.com research team suggest you two most usable strategy which success rate

are eighty to ninety percent if you follow our instructions properly.

Those are

1. Aggressive Entry and Exit Strategy when Golden Cross.

2. Traders Action Zone (TAZ) Entry and Exit Strategy.

Let’s explore both…..

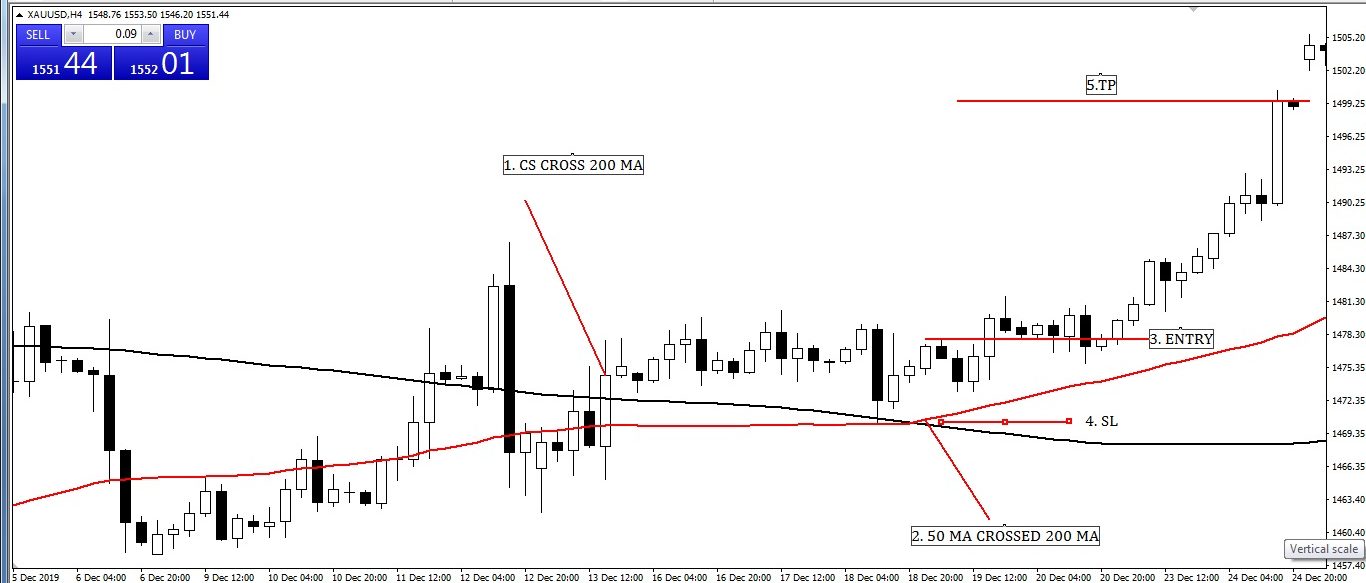

Aggressive Entry and Exit Strategy when Golden Cross.

Image point number – 1, We see candlesticks close above 200 Moving Average. That

means it’s an uptrend. Also, its time to wait and watch as per Aggressive Entry and Exit

Strategy when Golden Cross.

Image point number – 2, Maintaining sideways above 200 Simple Moving Average where

candlesticks never close below 200 Simple Moving Average. That means price is till now

bullish. We have to wait for Golden Cross.

At last Golden Cross was created. We hope that price will go up massively.

Image point number – 3, Aggressive or conservative trader put their BUY STOP order 2

pips above of Golden Crossing candlesticks.

Image point number – 4, After hit BUY STOP order aggressive trader place STOP LOSS 2

pips below of 50 Simple Moving Average.

Where, Conservative traders place STOP LOSS 2 pips below of 200 Simple Moving Average.

Image point number – 5, Conservative or aggressive trader place their take profit level on

near swing high or 1 : 2 or 1 : 3 risk-reward ratio.

Image 3:

Traders Action Zone (TAZ) Entry and Exit Strategy.

What is Traders Action Zone (TAZ): Before explore, this strategy, At first we have to

know what is Traders Action Zone (TAZ).

Traders Action Zone (TAZ) is actually this area of the chart where swing trader and pullback

trader take their position. Swing trader and pullback trader wait until price come Traders

Action Zone (TAZ).

Traders Action Zone (TAZ) area determined variously based on strategy,

This Golden Cross strategy Traders Action Zone (TAZ) is between 50 Simple Moving

Average and 200 Simple Moving Average until setup invalid.

Let’s explore….

Image point number – 1, We see candlesticks close above 200 Moving Average. That

means its uptrend. Also, its time to wait and watch as per Traders Action Zone (TAZ) Entry

and Exit Strategy.

Image point number – 2, After Golden Cross price go up massively. But as per Traders

Action Zone (TAZ) Entry and Exit Strategy we have to wait until the price comes back Traders

Action Zone (TAZ).

Image point number – 3, At last price come back in Traders Action Zone (TAZ). Now time

to Look for bullish price action reversal candlesticks pattern (PIN BAR, BULLISH

ENGULFING, MORNING STAR, HAMMER, HARAMI, PIERCING, DOJI etc.)

Image point number – 4, Aggressive or conservative trader put their BUY STOP order 2

pips above of Bullish Engulfing candlesticks in Traders Action Zone (TAZ) area.

Image point number – 5, After hit BUY STOP order aggressive trader place STOP LOSS 2

pips below of Bullish Engulfing candlesticks.

Where, Conservative traders place STOP LOSS 2 pips below of 200 Simple Moving Average.

Image point number – 6, Conservative or aggressive trader place their take profit level on

the near swing high or 1 : 2 or 1 : 3 risk-reward ratio.

Death Cross Entry-Exit Strategy:

Before exploring the Death Cross Entry-Exit Strategy at first we learn to know what is Death

Cross.

What is Death Cross: Few time world heavyweight news channels or newspapers (e.g. BBC,

CNN and BLOOMBERG) published breaking news that EURUSD created Death Cross. After

this news market tries to create new low and low. It’s specially SELL mood because of

Death Cross.

Actually when Midterm Moving Average crosses Long Term Moving Averages from up then

market create Death Cross.

As very much simple, When 50 Simple Moving Average crosses 200 Simple Moving Average

from up its Golden Cross. You also can use Exponential Moving Average here.

Various types of Death Cross Entry and Exit Strategy are practiced in the financial market.

Earnmoneyfx.com research team suggest you two most usable strategies which success

rate are eighty to ninety percent if you follow our instructions properly.

Those are….

1. Aggressive Entry and Exit Strategy when Death Cross.

2. Traders Action Zone (TAZ) Entry and Exit Strategy.

Let’s explore both…..

Aggressive Entry and Exit Strategy when Death Cross.

Image point number – 1, We see candlesticks close below 200 Moving Average. That

means its downtrend. Also, its time to wait and watch as per Aggressive Entry and Exit

Strategy when Death Cross.

Image point number – 2, Maintaining sideways above 200 Simple Moving Average where

candlesticks never close up 200 Simple Moving Average. That means price, is till now

bearish. We have to wait for Death Cross.

At last Death Cross was created. We hope that price will go down massively.

Image point number – 3, Aggressive or conservative trader put their SELL STOP order 2

pips below of Death Crossing candlesticks.

Image point number – 4, After hit SELL STOP order aggressive trader place STOP LOSS 2

pips above of 50 Simple Moving Average.

Where, Conservative traders place STOP LOSS 2 pips above of 200 Simple Moving Average.

Image point number – 5, Conservative or aggressive trader place their take profit level on

near swing low or 1 : 2 or 1 : 3 risk-reward ratio.

Traders Action Zone (TAZ) Entry and Exit Strategy.

Image point number – 1, We see candlesticks close below 200 Moving Average. That

means its downtrend. Also, its time to wait and watch as per Traders Action Zone (TAZ)

Entry and Exit Strategy.

Image point number – 2, After Death Cross price are sideways. But as per Traders Action

Zone (TAZ) Entry and Exit Strategy we have to wait until the price comes back Traders Action

Zone (TAZ).

Image point number – 3, At last price come back in Traders Action Zone (TAZ). Now time

to Look for bearish price action reversal candlesticks pattern (PIN BAR, BEARISH

ENGULFING, SHOOTING STAR, HARAMI, DARK CLOUD COVER, DOJI etc.)

Image point number – 4, Aggressive or conservative trader put their SELL STOP order 2

pips below of Bearish Engulfing candlesticks in Traders, Action Zone (TAZ) area.

Image point number – 5, After hit SELL STOP order aggressive trader place STOP LOSS 2

pips above of Bearish Engulfing candlesticks.

Where, Conservative traders place STOP LOSS 2 pips above of 200 Simple Moving Average.

Image point number – 6, Conservative or aggressive trader place their take profit level on

the near swing high or 1 : 2 or 1 : 3 risk-reward ratio.

——- Thanks for giving your valuable time to read this article ——–

(To be continued)

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience