How Is the Exponential Moving Average

Moving Averages ar one in all the foremost in style and straightforward to use

indicators available in Forex. They smooth a data series and make it

easier to identify trends, one thing that’s particularly useful in volatile

markets. They conjointly kind the building blocks for several different technical

indicators and overlays.

The two hottest varieties of moving averages ar the easy

Moving Average (SMA) and the Exponential Moving Average

(EMA).

A Simple Moving Average

A Simple Moving Average (SMA) is made by computing the common

(mean) worth of a security over a specified variety of periods. While it

is possible to form moving averages from the Open, the High, and

the Low knowledge points, most moving averages are created using the

closing price. For example a 20-day simple moving average is

calculated by adding the closing costs for the last twenty days and

dividing the total by 20.

In order to cut back the lag in straightforward Moving Averages (SMAs),

technicians often use Exponential Moving Averages (EMAs). EMAs

reduce the lag by applying additional weight to recent costs relative to

older prices. The shorter the EMAs amount is that the additional weight are going to be

applied to the most recent price.

The Simple Moving Average (SMA) is represented in black and the

EMA is the blue line.

Which moving average you employ can rely upon your commerce and

investing style and preferences.

The simple moving average clearly includes a lag, but the exponential

moving average may be prone to quicker breaks. Some traders prefer

to use exponential moving averages for shorter time periods to

capture changes quicker. Some investors prefer simple moving

averages over very long time periods to spot semipermanent trend changes.

Shorter moving averages are going to be additional sensitive and generate additional

signals. The EMA, which is mostly a lot of sense than the SMA,

will also be likely to generate more signals. However, there will also

be a rise in the variety of false signals. Longer moving

averages will move slower and generate fewer signals. These signals

will seemingly prove a lot reliable, but they also may come late.

Each capitalist or dealer ought to experiment with completely different moving

average lengths and kinds to look at the trade-off between

sensitivity and signal reliability.

Because moving averages follow the trend, they work better when a

currency pair is trending and are ineffective when a currency pair

moves in a trading range.

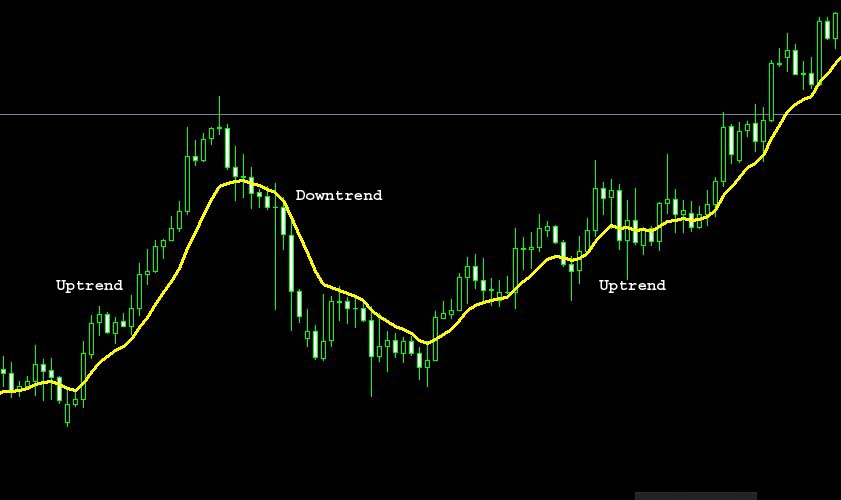

A – Trend Identification and Confirmation

If the worth is on top of a moving average and this moving average is

moving up, we’re in an uptrend.

If the moving average is moving down and therefore the value is below the

moving average, we’re in a downtrend.

Here is an example using a 20 days Simple Moving Average:

This chart shows you that moving averages help you spot the current

trend easily.

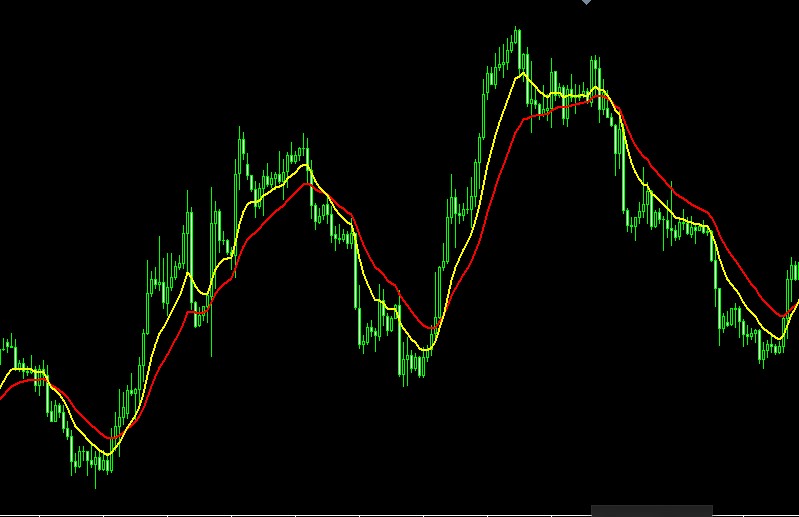

You can conjointly use a pair of completely different Moving Averages to identify the trend. For

example, if you use a 10 and 20 moving averages. If the SMA10 is

above the SMA20, you’re in an uptrend. If the SMA10 is below the

SMA20 you’re on a downtrend.

Here is another example that shows you that you can also spot a

trend using 2 different moving averages.

B – Support and Resistance Levels

Another use of moving averages is to spot support and resistance

levels. this can be typically accomplished with one moving average and is

based on historical precedent.

As with trend identification, support and resistance level identification

through moving averages works best in trending markets.

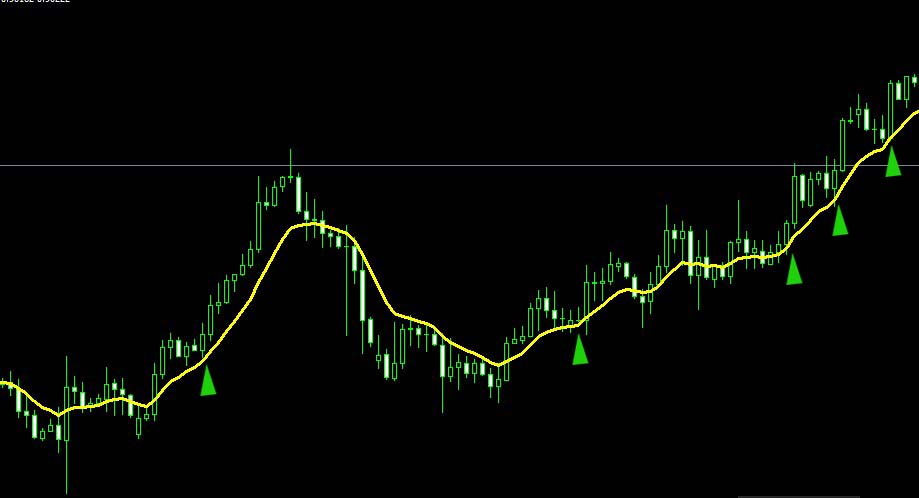

This example shows you how a moving average works on a strong

uptrend. The moving average was a good support area during this

uptrend. This strong support area can be used as an entry point.

There are even some trading systems build solely on moving

averages. On this kind of system, when the price crosses the moving

average to the top side could be a purchase and once it crosses below the moving

average is a sell. On sturdy trends, this kind of trading system works

well. However, throughout stormy markets, their ar many false

signals for this kind of system.

The Moving-Average Approach

The moving-average approach combines elements of the Bollinger band

approach with elements of the entry techniques for longer-term trades based on

the major trend. It is particularly effective for entering a trade when there is already

a setup on the basis of the entry checklist for a market that you expect you would

like to enter. Using the intraday chart strongly reinforces the odds in favor of getting into a trade just as it

is starting to go on the basis of the daily entry signal.

There is an almost unlimited number of considerations for day trading that

work some of the time, but there is hardly one more important than to make sure

that the overall picture is favorable on the weekly and daily charts for the intended

trade. Except for occasional and conspicuously inviting contra-trend trades at an

obvious extremity, good short-term speculation should, almost axiomatically,

have the potential to develop into a longer-term trade. Successful short-term trading should seldom deviate far

from the following approaches that work well most

of the time for entries.

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience

Very nice post. I just stumbled upon your blog and wanted to say that

I’ve truly enjoyed surfing around your blog posts.

In any case I will be subscribing to your feed and I hope you write again very soon!

Greetings! Very helpful advice in this particular article!

It’s the little changes thast make the most implrtant changes.

Many thanks for sharing!

Unquestionably imagine that that you stated. Your favourite justification seemed to be at the web the simplest thing

to take note of. I say to you, I certainly get irked

while people consider worries that they just don’t recognize about.

You controlled to hit the nail upon the top and also defined out the

entire thing with no need side-effects , people can take a signal.

Will probably be again to get more. Thank you