It’s easy to become a forex trader. Just simple, Open an account any forex broker. Download MT4 or MT5 software. Deposit your investing amount. Start trade in forex. Wow, I am a forex trader. Hello guys, Don’t feel so happy. You are just a forex trader not to become a successful forex trader. You just stay initial steps of forex industries. It is the largest industry in the financial sector where daily exchange value is not less than ten trillion. Here Eighty to Ninety percent trader lose their money. As an individual trader, You have to fight here with Central Bank, Hedge Fund, Multi Billionaire Individual investor, and large financial institute. So it’s not easy to be a consistent forex trader if you have no idea about how to be a successful forex trader.

Between forex trader and consistently profitable forex trader are huge differences. Anybody can be a forex trader but not be a consistently profitable forex trader. For that, we write this lesson to you. And it will learn you how to be a profitable forex trader.

Below steps, you must have to follow strictly which will help you to become a successful forex trader.

- Learn about forex basic

- Select a suitable broker and platform

- Learn details of forex fundamental analysis

- Learn technical analysis

- Create trading rules and strictly maintain it

- Create psychological rules and strictly maintain it

- Currency pair, crypto, commodity selection

- Time frame selection

- Set one or more trading strategy

- Market search

- Risk and Money management

- Set and forget

Learn About Forex Basic:

Become a successful forex trader, You must have learned basic knowledge of forex. That’s are,

- What is Forex?

- Who trade Forex?

- When and which instruments are trades in Forex?

What is Forex?

According to Investopedia, Forex is a case of foreign currency and exchange. It’s the only process to exchange one currency to another currency. Basically, foreign exchange happened for various reasons. Usually for International trading, tourism and commerce. More than 100 types of official currency in the world. However, Most international forex trade and payment happened by the US Dollar, British Pound, Euro, Japanese Yen, Australian Dollar, Canadian Dollar, New Zealand Dollar, Swiss Franc, and Chinese Yuan Renminbi.

Who trade Forex?

Forex market is the largest financial market in the world, with a daily volume of $10 trillion. Vice versa $100 billion equity trade daily. Here many types of players play their role every working day. Major players are,

- Central Bank

- Commercial and Investment Bank

- Hedge Fund

- Investment Manager

- Multinational Corporation

- Billionaires Individual Investor

- Retail Trader

When and which instruments are trades in Forex?

Forex market is open 24 hours a day, five and a half days a week. Also, forex traded major financial centers of the worldwide as like as, New York, London, Beijing, Tokyo, Hongkong, Zurich, Frankfurt, Singapore, Paris, Sydney, etc.

Major pairs, Cross pair, Spot Market (Future, Options, Commodity, Metal), and Cryptocurrencies are trading here.

Major Pair: EURUSD, GBPUSD, AUDUSD, NZDUSD, USDJPY, USDCHF, USDCAD

Cross Pair: GBPJPY, AUDNZD, CADCHF, CADJPY, USDCNY, EURAUD, etc. Trade except for major pair call Cross air.

Spot Market (Future, Options, Commodity, Metal): Various stock (AAPL, AMZN, GOOGLE, etc), USOIL, S&P 500, HK50, XAUUSD, XAGUSD, etc.

CryptoCurrency: BTCUSD, LTCUSD etc

Select a Suitable Broker and platform:

Now you are in the second step to be a profitable forex trader. This stage you learn about suitable forex broker and their platform.

Various forex broker is ready to serve you with their various facility. Different broker provides different types of facility. Which will puzzle you to choice broker. Don’t be silly. The solution creates before the problem arises. We just have try to find out it. Here we don’t mention any specific broker. Which broker you select is not a matter but you must have to ensure below services from it.

- Regulated Broker

- Low Spread Account

- No Slippage

- Well equity provider etc.

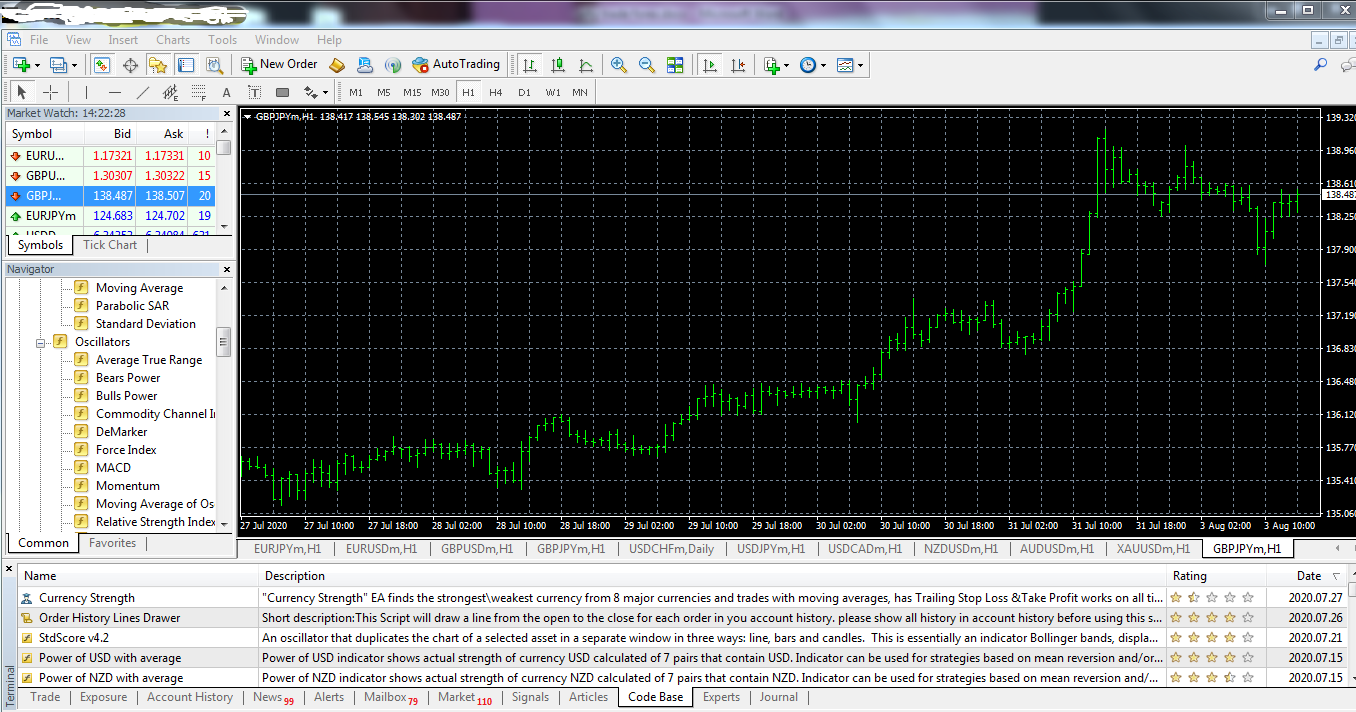

The various broker provides various type of platform. But most of the broker has the same platform which uses by the worldwide trader. And, That’s are

- MT4

- MT5

Learn Details of Forex Fundamental Analysis:

Till now you gather huge knowledge about forex basic and broker. Also broker trading platform. But it’s not a time to be happy and start trading. You have a lot of things to know to become a fortunate forex trader. Let’s try to explore summery about forex fundamentals.

- What is forex fundamental analysis?

- Fundamental news

- Importance of fundamental news when trade forex.

What is Forex Fundamental Analysis:

Shortly, Analysis by economic, social, political data that force currency pair to move up or down is called forex fundamental analysis. Now a day, Social media e.g. Twitter, Instagram, Facebook also act strongly currency pair movement. For example, From a certain tweet from world leader affect currency price.

Forex Fundamental News or event:

Every country maintains its economy calendar was included a lot of events. E.g. Interest rate, Non-Firm Payroll, Unemployment rate, GDP, etc. Most of the country published their event as scheduled. Forex fundamental traders are eagerly waiting for that news. They ready to invest after a published event.

Important of forex fundamental News:

Big Investors to retail investors, all are eagerly waiting for published fundamental news. E.g. Before interest rate news of USD, Market going to sideways which we observed in M15 to H1 chart. Because all are aware of USD interest rate news. Thus the market lost her liquidity for few times. Thereafter, If the interest rate goes favor on USD, Then USD move massively.

Also, Most forex fundamental trader planned their investment based on the fundamental event. E.g. Federal Reserve cut interest rate and show forecast they will also cut the next meeting. Fundamental trader avoids investing USD. They withdrew their investment from USD and try to invest another pair for the mid and long term.

If we start our career as a forex fundamental trader, we must have an idea every single thing about forex fundamentals. Otherwise, we must lose our investment.

Learn Details of Technical Analysis:

Technical analysis is one of the major elements which will create you a profitable forex trader. Also, it’s our preferable elements because the fundamental analysis is so so critical and time being. Vice versa, Technical analysis is easier than fundamental analysis. Also, it’s easy to learn and adopt. Be an excellent technical analyst, you must have to know below things.

- What is technical analysis?

- Why we prefer technical analysis?

- Indicators of technical analysis

What is Technical Analysis:

According to babypips, Technical analysis is those frameworks where traders analyse the only price movement.

Today the field of technical analysis builds by the father of technical analyst Dow Jones. Most of the professional technical analyst accept these below three general assumptions for discipline.

- Price discounts everything.

- Price moves on trend

- History repeats itself.

If you understand the above three things deeply, You must be a professional technical analyst which also helps you be a successful forex trader.

Why we prefer technical analysis:

As before discussed, Fundamental analysis is critical. And its direction also variable from time to time. Because economic data change regularly.

Other important things are situated in Dow Jones first theory.

“PRICE DISCOUNT EVERYTHING”

Thus if you can read the chart properly, you must assume the effect of the next fundamental data.

Also, Technical analysis is easier to learn and adopt of fundamental analysis.

Indicators of Technical Analysis:

Various types of indicators we find in technical analysis. These are,

- Trend Indicator

- Oscillator Indicator

- Volumes Indicator

- Bill Williams Indicator etc.

Trend Indicator |

· Moving Average (MA)

· Average Directional Index (ADX) · Ichimoku Kinko Hyo · Parabolic SAR etc. |

Oscillators Indicator |

· Average True Range (ATR)

· Bull, Bears Power · Commodity Channel Index (CCI) · Moving Average Convergence Divergence(MACD) · Relative Strength Index (RSI) · Stochastics Oscillator · Williams Percent Range etc. |

Volumes Indicator |

· Accumulation/Distribution

· Money Flow Index (MFI) · On Balance Volume (OBV) · Volumes |

Bill Williams |

· Alligator

· Awesome Oscillator · Fractal etc. |

Don’t worry about the above-mentioned indicator. You just try to know the definition and construction. All are built-in MT4 and MT5 platforms.

There are other major elements in technical analysis. Without an idea about it, you never be a successful technical analyst. Also never be a successful forex trader. Because, Most of the forex technical analysis, Central Bank, Commercial Bank, Hedge Fund, and Billionaires Individual traders keep focus on it. That is PRICE ACTION ANALYSIS.

Major elements of price action analysis are,

Support & Resistance |

· Monthly

· Weekly · Daily · Four Hourly · Hourly |

Trend Line |

· Monthly

· Weekly · Daily · Four Hourly · Hourly |

Candlesticks Pattern |

· Engulfing Candlesticks Pattern

· Pinbar Candlesticks Pattern · Doji Candlesticks Pattern · Harami Candlesticks Pattern · Twizzer Top Candlesticks Pattern · Twizzer Bottom Candlesticks Pattern · Piercing Bar Candlesticks Pattern · Inside Bar Candlesticks Pattern etc |

Chart Pattern |

· Double Top Pattern

· Double Bottom Pattern · Triple Top Pattern · Triple Bottom Pattern · Head and Shoulder Pattern (H&S) · Reverse Head and Shoulder Pattern · Ascending Triangle Pattern · Descending Triangle Pattern · Symmetrical Triangle Pattern · Channel etc. |

You must have gathered a deep idea about above all. Otherwise Failure……..

Create Trading Rules and Strictly Maintain it:

Till now you learn academic knowledge to be a successful forex trader. But it was only thirty percent steps. Now time to explore a new era.

Forex trading success depends on Mind, Money, Method.

Here we discuss Method/Rules. Method or rules are created by below things,

- Establish a strategy

- Trade demo account

- Note demo account result

- Set Stop Loss and Take Profit Level

- Avoid Over Trade

Establish a Strategy:

Suppose you like to trade price action. And you choose chart patterns for trade. Now time to establish your chart pattern strategy. Double top, Double bottom, Triple top, Triple bottom your favorites chart pattern. Because it’s easy to understand and repeat available in the chart.

Now your trading strategy as below,

- Trade only chart pattern. There is no value for you candlesticks pattern, support resistance, trend line, and any other indicators.

- Between chart pattern, You only trade Double top, Double bottom, Triple top, Triple bottom chart pattern. Always ignore another chart pattern.

Trade demo account:

After an established trading strategy, its time to demo test your strategy. The more you demo test, the more you create a successful trading strategy. No matter how time you spend. Your main goal is to create perfect your strategy. Until perfect everything, you don’t stop. Because it will be very painful if you lose money in real trade lack of more and more demo trading your strategy.

Note demo account result:

Note down the demo account result is very very important. Though you find the trading result in MT4 or MT5 history but you must have maintained Demo Trading Journal. The main benefit of maintaining a trading journal is its looks like glass. Here you see all of your historical activities. Also, it help you to determined, Is your trading strategy is perfect? Have need any change in trading strategy?

Set Stop Loss and Take Profit Level:

Suppose your demo trading strategy is excellent. But you do not use Stop Loss and Take Profit Level. We suggest you throughout this strategy immediately. Without set Stop Loss and Take Profit Level, if you doubling your account within fifteen days but there is no value of your strategy. It is a forex market. Anything can happen here. So if you double your account within fifteen days, there is a great chance to zero your account within one hour. Thus the ultimate result is bankrupt.

So if you not practice set Stop Loss and Take Profit Level on demo trading, we damn sure you must avoid it real trading. That will make you a failure forex trader. The below image will be the best example of the importance of using a stop loss.

Avoid Overtrade:

As per your strategy, you will find more trade opportunities. But you must have wait for the perfect setup.

For example, you find a double top on your chart. But the second top is a few lower than the first top. Here both things will happened, the price will reverse or continuation. Here you have to wait for candlesticks close on your time frame. Also, need confluence e.g. reversal candlesticks pattern or divergence.

Remember one thing, Perfect trade brings a lot of money. Vice versa, over trade will create your account gradually down.

So always try to avoid overtrading. If you don’t practice it in the demo session, you must face a lot of problem in real account.

Create Psychological Rules and Strictly Maintain it:

Another pillar of a successful forex trader is MIND. During the mentally absurd position of a trader, the ultimate trading result must be poor. Below here are few psychological rules,

- Choose a quiet place for trading

- Meditation regularly

- Have a written trading plan

- Accept Loss

- Don’t be greedy

- Take rest if you pass a bad week

Choose a quiet place for trading:

Choose a quiet place is very much important when you trading. Because you must have your mind cool. Because trading is art. Also trading success pillar creates gradually. When you trade-in an annoying place, it’s very much difficult to take the right trading decision. Thus you lose money.

Meditation Regularly:

Meditation regularly helps your mind stay cool. Also, its have scientific proof. When your mind is cool, your trading decision must be accurate. Thus your capital increase, you are feeling happy.

Have a Written Trading Plan:

You must have written your trading plan. It will help you avoid mistakes when trading. If you don’t write a trading plan, a few times later you start trade out of your strategy. Thus the result is zero. Not only a written trading plan but also must check when taking your trading decision severally. YOU MUST HAVE to MAINTAIN IT.

Accept Loss:

There is no trading strategy bring a 100% success ratio. So the loss is practical. You must have grown your mentality to accept the loss. 60 to 70 percent success ratio trading strategy is acceptable everywhere. Here one thing is very much important, You must manage to take profit level 1:2 or 1:3 more. Thus, if your strategy brings 30 to 40 percent loss ratio, ultimately you will be profitable.

Don’t Be Greedy:

If you determined to be a successful forex trader, you must stop be greedy. Only greed can make looser trader from a consistently profitable trader. You must have stick in your strategy.

For example, You set take profit level 1:3 and price already hit your take profit level. Don’t watch this market after your take profit level hit. Because the price will go so far after hit your take profit level. That’s time greed and frustration work your mind. For that reason, you will make the wrong decision. Thus the ultimate result is stop loss hit. You return to market your profit share.

Also, stop loss hit of this trade will create embargo your next trading decision. Because you just lose your confidence in your greed.

So never be greedy. If the market hits your take profit level, be happy. And think that, Wow I am in profit now vice versa another one is looser now. Show sympathy for him/her. It will help you to not be greedy. And search for another market to make decisions based on your strategy.

Take rest if you pass a bad week:

Happiness and sorrow attract each other. So, It will not be every week or month in your favor. You will have pass a bad week or month. Always be ready for it. A professional forex trader has a specific plan to handle this situation. And it is, Takes rest from market few hours, days, week. How long take rest depends on your mental situation. Till do not feel mentally well, you do not need to watch chart. Remember, Until you have the capital to invest, you can invest anywhere. If you don’t have any capital, your strategy will not bring anything for you. So preserve capital is very important.

Currency Pair, Crypto, Commodity Selection:

If you understand the above-mentioned lesson, we assure you that you are going on the right path to be a successful forex trader. But remember, you must have a strict trading plan.

Now time to select currency pair, crypto, commodity for trade. If you are fully novish in forex market, we suggest you select only one pair. Minimum a hundred more perfect demo trade with your strategy on this pair. Between this time you have a lot of ideas about this pair e.g. daily range, pair nature, volatility measurement, event or news impact, etc.

For your information, It’s not mandatory to trade all pairs. You must have to prefer the risk-reward. If you can earn a monthly 15% return from single pair trading, no need to try choice one more pair. End of the day or month, the fruitful result is the final word.

When you reach an advanced level of trading, you may choose five to ten pairs for observation. But don’t trade all pairs at a time despite your strategy give the perfect signal. A total of four to five risk is enough for this level. You have remembered that without loss there is no trading strategy. So when you risk more, there is more chance to lose. Never do it. Trading is a marathon, not a hundred-meter sprint. So slow and steady prospect with discipline will help you to be a remarkable forex trader.

When you understand that now you are a professional level trader, then try to focus all types of market. Because professional trader not only trades own capital but also trade client account too. So few time client requests you to trade their selected script. E.g. if your client is American, he/she will request you to trade S&P 500 with others. If he/she in Chinese then requests for trade HK50 especially. Don’t worry about it. Because your strategy will be identified where buy or sell. Every chart has one characteristic, Supply and Demand. You just try to identify which zone your selected script or pair situated.

The below list is earn money forex research team suggest currency pair, equity, crypto, equity, commodity which you will add your list.

Major Pair |

· Euro vs United States Dollar (EURUSD)

· Great British Pound vs United States Dollar (GBPUSD) · New Zealand Dollar vs United States Dollar (NZDUSD) · Australian Dollar vs United States Dollar (AUDUSD) · United States Dollar vs Canadian Dollar (USDCSD) · United States Dollar vs Swiss Franc (USDCHF) · United States Dollar vs Japanese Yen (USDJPY)

|

Cross Pair |

· EURCAD

· GBPCAD · NZDCAD · EURAUD · GBPAUD · EURNZD · GBPNZD · AUDNZD · EURGBP · EURJPY · GBPJPY · AUDJPY · NZDJPY

|

Commodity |

· Gold vs United States Dollar (XAUUSD)

· Silver vs United States Dollar (XAGUSD) · United States Dollar vs Crude Oil (USOIL)

|

Crypto |

· Bitcoin vs United States Dollar (BTCUSD)

· Litecoin vs United States Dollar (LTCUSD)

|

Indices |

· S&P 500 |

Equity |

· Amazon

· Aaple · Microsoft · Walmart · Alibababa

|

Never take risk of more than six percent when you are a professional forex trader. And advance trader four percent, novish trader two percent.

Time Frame Selection:

Before select time frame for trading, a few important things you must have to maintain before analyzing any chart. These are,

Monthly Chart >>> Weekly Chart >>> Daily Chart >>> 4 Hourly Chart >>> Hourly Chart

Apply this technique, you have an idea about the selected pair or chart supply-demand situation in long, mid, and short term situation.

Time frame selection depends on you. Elaborately, If you have enough time for trading then watch One hourly chart, few times then four-hourly or daily, limited-time then weekly or monthly. The more bigger time frame trade, the more chance to profit.

If you are a day trader, must-watch M5, M15, M30 time frame which one have suite. But a small time frame creates a lot of noise. Thus a very high chance to hit stop loss more and more.

When you are a swing trader then must watch H1, H4 time frame chart.

And as a position trader then must watch daily, weekly, monthly time frame charts.

Set One or More Trading Strategy:

Wow, you complete seventy percent journey to be a successful forex trader. Now time to explore the next level.

Every forex trader must have maintained one more strategy. Never dependable on one strategy. Pros and Cons between one and one more strategy as below,

Details |

Pros

|

Cons

|

One Strategy |

· Easy Adoptable

· Easy Applicable · Identify perfectly because of more and more apply |

· More time wait for the new entry

· Less trade than less profit · No backup plan |

One More Strategy |

· Backup plan

· More trade chance · Less time waiting for the new entry |

· Not so easy to applicable

· Sometimes face difficulty for identity |

When you are novish trader, one strategy is suitable for you. But advance and professional level, you must apply two strategies. Let’s explain by example,

You are a professional forex trader. And you have to manage a few client accounts. You committed to returning them twenty percent quarterly against there ten million us dollar fund. Though ten million us dollar fund is big, so we will take risk one percent per trade. If you trade based on one strategy, it will very much difficult to fulfill your commitment to the client. But when trade on two strategies, it will be easy. E.g. Reversal and Continuation patterns are your two strategies.

For reversal, You choose below chart pattern,

- Double Bottom Pattern

- Double Top Pattern

- Triple Bottom Pattern

- Triple Top Pattern

For continuation, You choose below chart pattern,

- Ascending Triangle

- Descending Triangle

- Symmetrical Triangle

And you will trade EURUSD, GBPUSD, AUDUSD, NZDUSD, USDJPY, USDCAD, USDCHF, XAUUSD, BTCUSD and S&P 500.

Price never goes straight. It always maintains zigzag. So if you adopt reversal and continuation strategy smartly, then we assure you that you must get twenty more chance for entry hourly or four hourly time frame. Below calculation is for your easy understanding,

Total Trade |

16 |

Stop Loss Hit |

8 Trade |

Take Profit Hit |

8 Trade |

Risk per trade |

1% |

Risk Reward |

1:2 |

Month-end result |

8% Profit |

Quarterly Profit |

8*4= 32% |

Commitment to client |

20% quarterly |

Ultimately you and your client both are happy

Market Search:

You just complete an eighty percent journey to be a successful forex trader. Be patience. Only patience will create you a successful leader in this field. As before discuss and suggestion, Now you have thirty-one pairs/Equity/Commodities and two strategies for trade. And your preferable time frame is four hourly charts. Also keep your eyes on a daily, weekly, monthly chart for identifying long term supply-demand situations. Its time to market search. Wait…… Before start a market search you must do meditation and focus on strategy details. After cross-checking with the checklist now start the market search. Always try to follow the below technique for market search.

Major Pair >>> Cross Pair >>> Crypto >>> Commodities >>> Indices >>> Equity

Suppose EURUSD shows long signal as per your strategy. And EURJPY shows short signal. Don’t be hurry to long and short both pairs. Here one thing you must have cross-checked every long or short. And it is a FOREX CORRELATION. You can check it here. Also, you can search google for another website.

By checking forex correlation, you avoid doubling your risk. EURUSD and EURJPY have a strong correlation. In general, EURUSD and EURJPY both are showing the same signal. E.g. Same Long or Same Short signal. But at present market search, you find EURUSD show long signal and EURJPY show short signal. As on currency correlation rules, there something wrong. Now you have to choose only one pair for entry. So try to identify which signal is very much accurate and strong. After judgment accurately, the EURUSD Long signal show more accurate. So why you are doing lately. Go long EURUSD. Are you worried, How much risk you take this trade? OK, Don’t be frustrated. You must discover its next.

You do not need to check correlation when trade commodity, crypto, indices, equity.

Strongly check it when you trade major and cross pair. A lot of risk doubling signal you will get but handle it carefully to protect capital.

Risk and Money management:

Till now we have complete ninety percent path to be a successful forex trader. After reading the risk and money management segment, you will complete a hundred percent of your journey. Feeling excitement! LOL, you will have to complete hundred ten percent journey. Feeling SHOCKED.

Obviously think, EMF team gone to mad. We don’t care what you are thinking about us. But we reply again that you will have to complete the rest hundred ten percent path. Let’s explain,

Novish, Intermediate, Expert every type of trader must hear about forex holy grail. All are trying to discover forex holy grail strategy. But failure. Actually, there is no holy grail strategy in forex. But holy grail are available here. And it is risk and money management. E.g. you have a successful strategy, selected pair/commodity/equity/crypto/indices, preferable time frame for trade. Also, you know all the basic and advance things of forex. Thereafter, you have a great chance of failure here. If you do not follow risk and money management strictly. Below an example for yours,

You have $10000 for trade. And identify two pairs for trade as your strategy. How much risk will you trade those two pair?

Is it a total of your capital?

Is it fifty percent of your capital?

Is it twenty percent of your capital?

Is it ten percent of your capital?

If you choose anyone, we ensure that you will lose all of the capital as soon as possible.

So what percent I will take the risk, it’s your current question to us. We know about it. Before exploring it, you have to confirm how much loss you will accept normally. Because its very important to be you keep calm and stable here. The professional and experimental solution is here…..

If your capital size small, you may take risk 2% per trade.

If your capital size medium, you may take risks 1% to 1.5% per trade.

If your capital size big, you may take risks .5% per trade.

If your capital size huge big, no need to take the risk on percent. You may take risks about how much loss you can afford.

Again, you are surprised that small capital takes 2% risk but big account take a 1% risk. Remember, Here the main focus is to afford loss, not capital size.E.g.

- $100000 fund 1% risk is $1000. And,

- $10000 fund 2% risk is $200

The risk amount is the main focus. Hope you understand clearly.

Another important thing you must have to know this segment is position sizing. For example, You identify EURUSD in a long position. The difference of stop loss and entry position is 50 pips. Your account size is $10k. And you take a 2% risk per trade. Thus your risk amount $200 and 50 pips.

Let’s calculate position/lot size.

(200/50= .04 lot in mini account)

Below table shows how difficult its to recover loss capital,

Capital Loss |

Required to Recover |

20% |

25% |

25% |

33% |

50% |

100% |

75% |

400% |

90% |

1000% |

Till 25% loss of capital absorbable and you can recover it. The next level is pretty much impossible if you are not a highly expert forex trader. That’s why risk and money management is so important and holy grail of forex.

Hope, we able to change idea about us. And EMF team was not mad. Ha Ha Ha…….

Set and Forget:

You complete all path of our journey to be a successful forex trader. Now time to maintain all strictly. And trade the real market. After getting any valid signal, You set stop loss and take profit level first. Then trigger trade with proper money management and position sizing. And forget about this trade. Either stop loss hit or take profit hit.

If you need trade management (trailing stop loss) then check this trade after a few times. Never observe closely after trigger trade. Before trigger trade, You do as best as possible. After trigger trader, give up your trade to market. Let’s watch what the market does for you.

Now we are in the last stage of this article. Bellow final words are for your easy understand.

- Learn learn learn as you can

- Practice as more as possible

- Create a practical strategy

- Always hold two strategies in your pocket

- Accept loss

- Take risk which you afford

- Before set stop loss level then take profit level

- Always set practical take profit level

- Don’t be greedy

- Don’t over trade

- Strictly follow trading rules

- Set those time frame for trade which will suitable for you

- Strictly follow money management rules.

Wish You the Best of Luck From Earn Money Forex Team

Happy Journey

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience

I do agree with all of the ideas you’ve offered on your post.

They’re really convincing and can definitely work.

Still, the posts are too quick for beginners. Could you please extend them a little from next time?

Thanks for the post.