RSI indicator buy and sell signals formula

The Relative Strength Index (RSI) is an extremely useful and populer momentum socillator.

The RSI Compares the magnitude of recent gains to he magnitude of recent losses and trust that information

into a number that ranges from 0 to 100.

There are multiple ways that you can use the RSI, Yu can use it to

spot overbought/oversold Levels, to spot divergences that show you a trend is losing steam, or you can use it to

confirm a trend.

A – Overbought/Oversold

RSI above 70 usually means the currency pair is overbought, so a top

might be near. RSI below 30 means the currency pair is oversold so a

bottom might be near.

Generally, if the RSI rises on top of thirty it’s thought-about a optimistic signal. If

the RSI falls below seventy, it’s a pessimistic signal.

Some traders determine the long-run trend then use extreme

readings for entry points. If the long-term trend is bullish, then

oversold readings could mark potential entry points.

B – Divergences

Buy and sell signals can even be generated by trying to find positive and

negative divergences between the RSI and also the currency try value.

If the worth reaches the next high however RSI isn’t able to reach a brand new

high, there’s a bearish divergence. If prices reach a new low, and RSI

can’t reach a new low, there’s a bullish divergence.

Divergences that occur when associate degree overbought or oversold reading

usually provide more reliable signals.

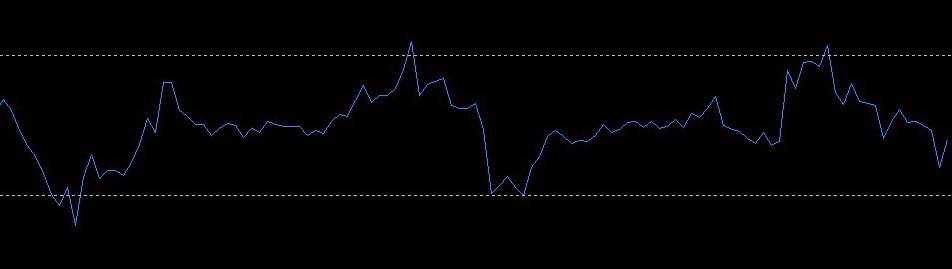

Here’s an example of a bearish divergence:

On point 2, EUR/USD was at an associate degree higher level whereas the RSI was at a

lower level comparing to point 1. This is a clear bearish divergence on

RSI. In this instance, EUR/USD went from 0.9265 to 0.8635 which

represents a 630 pips downtrend.

You can also see that around 0.8635 the RSI reached the oversold

level for the first time and this represented the exact bottom for

EUR/USD.

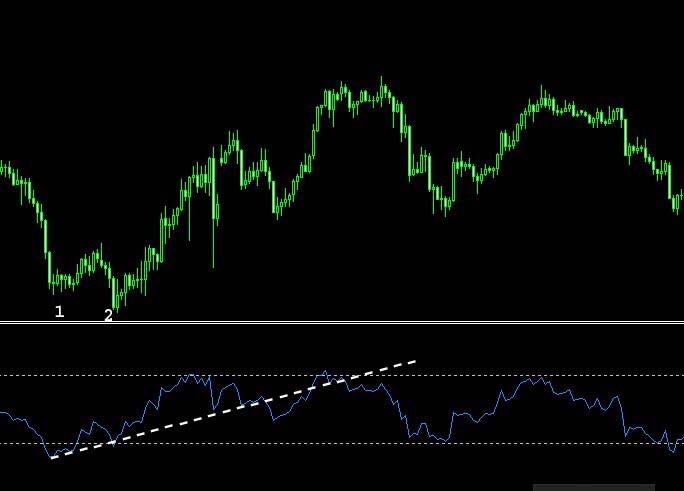

Let’s take a look at another example. This time we’re looking at a

bullish divergence on RSI:

As you can easily see, at point 2 the EUR/USD was at a new low,

while RSI was at a higher value. This was a clear bullish divergence

that pointed to the upside.

EUR/USD started a rally of just about one thousand pips till it reached a prime

when the RSI clearly marked an overbought point. Once again, RSI

was able to spot top and bottoms as few indicators can.

In this example, you can notice that at point 2, the price is around

the same level as at point 1. However, RSI is clearly above. RSI is

pointing for a rally in price due to this bullish divergence.

If you had purchased GBP/USD on this bullish divergence and sold it

once the RSI signaled associate degree overbought market, you would have bought

around 1.7475 and exited the trade around one.8200 with 725 pips

profit.

C – Centerline Crossover

A reading on top of fifty indicates that average gains square measure beyond

average losses and a reading below fifty indicates that losses square measure

winning the battle.

Some traders rummage around for a move on top of fifty to substantiate optimistic signals or a

move below 50 to confirm bearish signals.

In this chart, you can see a strong uptrend on EUR/USD confirmed by

an RSI above 50. When RSI crossed below fifty, the trend was beginning

to lose some strength. RSI let you know this in advance

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience