Believe it or not, it is quite simple. Have you ever noticed that in life, the

most obvious things are the hardest to see?

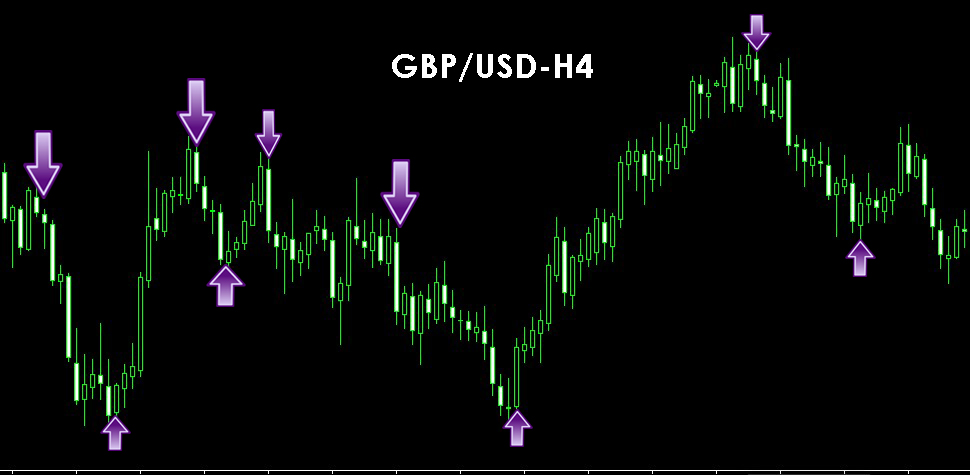

Bulls and bears keep track of all the previous highs and lows, no matter how far back they go. When bulls achieve a new high—higher than a

previous high—they do what I call “scoring a point,” and after the point is

scored, the market pulls back. Conversely, the bears, too, are trying to score

points by taking the market lower and making lower lows. When the bears

make a lower low, lower than a previous low, they “score a point,” which is

followed by a pullback

(Bulls and bears have memories like elephants; they never forget!)

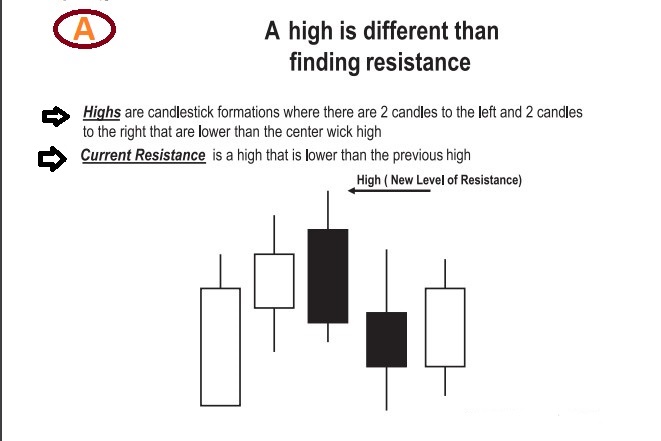

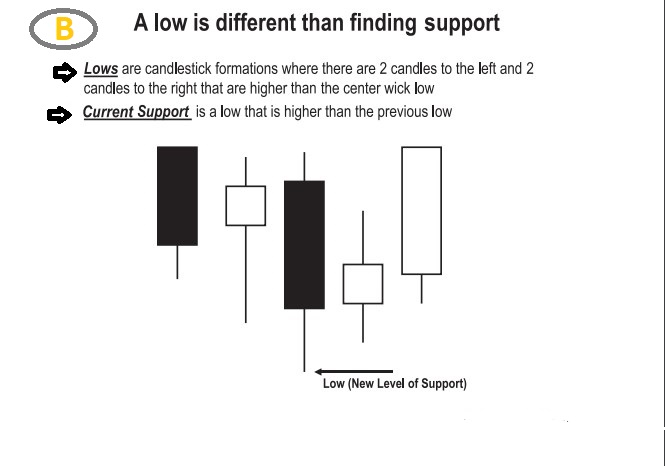

IDENTIFYING HIGHS AND LOWS

A high is visible as two candles to the left, two candles to the right that

are lower than the center candle, and either the body or wick is higher.

A low is visible as two candles to the left and two candles to the right

that are higher than a center candle, and either the body or wick is lower

RESISTANCE AND SUPPORT

Bulls and bears play this eternal game 24 hours a day, seven days a week.

Bulls fight for control, proving their strength by making new highs, and

bears fight for the opposite.

As they make new highs and lows, levels of support and resistance are

registered. The terms support and resistance were created back in the early

The 1900s in the stock market. Support occurs when traders begin buying, supporting a product, or stock, as it was falling. Conversely, resistance occurs

when traders feel prices are getting too high or expensive and they resist

buying at that price.

A and B

As traders supported a currency or stock at a certain price, a low or a new

low in price was created for that product, and when they resisted buying, a

new high was created for that currency. The game started when traders who

were buying and selling tried to take prices still higher or lower. Buyers

wanted prices to go lower so they could get a better deal, and sellers wanted

prices higher to enable greater profits. This game of trading started shortly

after Adam and Eve and has never ended. But it has just been within the past

few hundred years that it has been captured and monitored in charts.

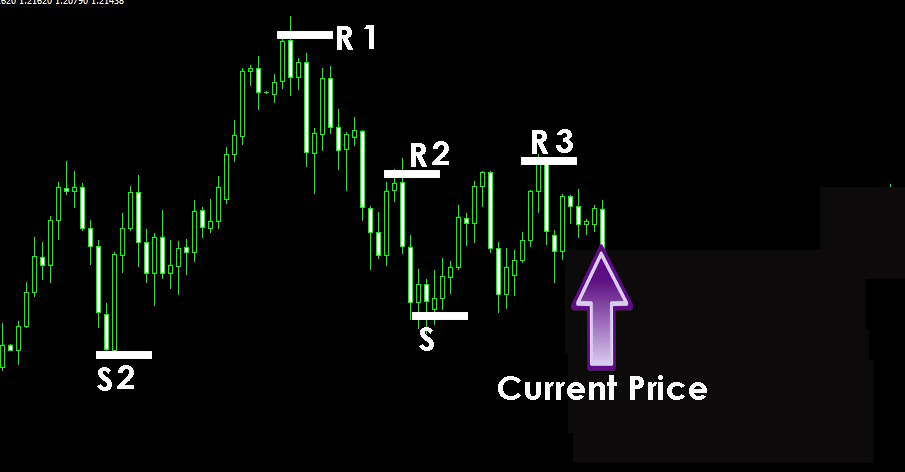

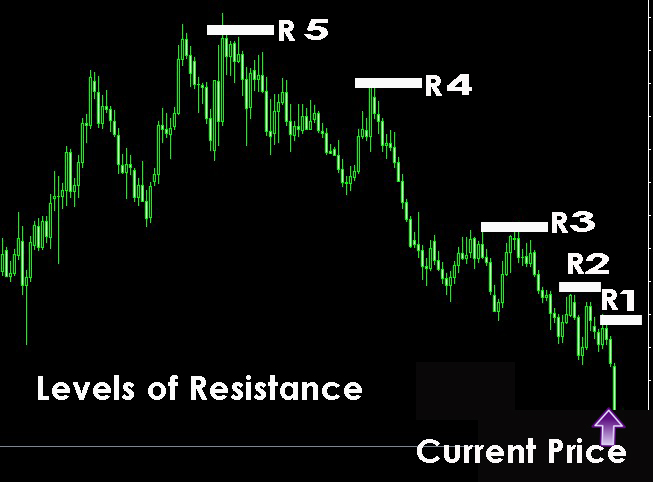

RESISTANCE

Resistance occurs when the bulls move the market to a new high that is

higher than a previous high and the bears jump in aggressively selling,

attracting more sellers than buyers, interrupting the rally and creating a

retracement or pullback from that high. The new high becomes the new

level of resistance, which is defined as a market high or a price level where

bears start selling enough to interrupt and reverse a rally

SUPPORT

Support occurs when bears move the market to a new low that is lower than

a previous low and the bulls jump in aggressively, buying to support the

price and attracting more buyers than sellers. That increased buying interrupts the dip and creates a retracement or pullback from that low. The new

low becomes the new level of support, which is where bulls start buying

enough to interrupt and reverse a dip. Bulls on the Forex are the buyers who

are looking for opportunities to buy a currency pair at a low price in order

to sell it at a higher price for profit (see Figure 5-3).

The definition of the phrase “buy low, sell high” differs from one bull

to another.

“Buy low, sell high” to you may mean buying a product for $10.00 and

selling it for $15.00. I may buy the same product for $7.00 and sell it for

$30.00. Either way, we are both buying low and selling high. However, if

you do your transaction seven times a day, you will make $35.00 and would

be considered “scalping.” I only need to do mine once to make $23.00 or

twice for $46.00, which is considered day trading. In the best of all possible scenarios, we would both buy right at the U-turn low and sell right at the

U-turn high, but rarely does it work that way. Most successful traders are

more focused and more comfortable trading mid-way of a price swing,

rather than going to extreme lows and highs in pursuit of profit.

As you read on, you will see I have pretty much figured out the where

and when to enter the market, as well as the why—which is the logical and

the educational reason behind entering the market at this point. Knowing

where the projected lows and highs will be will allow you as a trader to

know when it is time to get in and get out of the market.

Bulls want to take the market to higher levels, enabling them to buy

low and sell high. It is important to know how to identify those potential

targets the bulls are aiming for. Past highs or major levels of resistance can

be determined by looking at the current price and then working your way

backward as if you were climbing up a set of stairs

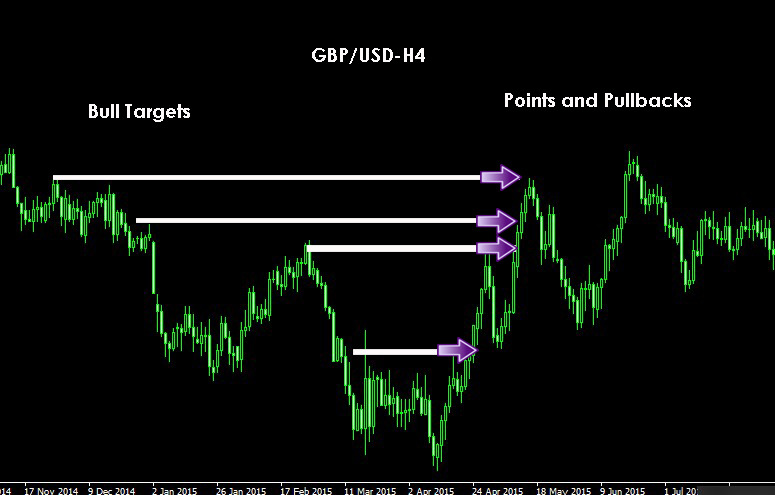

The major levels of resistance are the targets the bulls will be aiming

for if they are in control or if they take back control from the bears.

This happens when the market has reached a past level of resistance and

established a new high. There are two reasons for a pullback, as seen in

1. The first reason for a pullback could be the fact that traders that take

short positions most of the time place their protective stop-loss orders

near the last highs. This means that when the bulls hit that area, there

is a lot of buy stop orders and a lot of selling—perhaps more selling

than buying—taking place. Bulls succumb temporarily, bears start to

gain a little territory, and a pullback or dip takes place. As a rule,

prices will continue to fall until the bulls step in and support the price.

Bulls normally support the price at one of three locations:Near a past level of support

Near an uptrend line

At a Fibonacci up retracement number

Sometimes all three are at the same numerical price point, which is

then called a convergence.

2. The next reason for a pullback could be a Fibonacci up extension

level. We will go into more detail about Fibonacci numbers in

If the past level of resistance is penetrated and the uptrend is going to stay

in place, the bulls will step in and start buying heavily near the last low or

level of support. The first level of support becomes a great area to go long

in the market, provided you get a bullish candlestick formation near a level

of support

LEARNING TO SHORT THE MARKET

Bears wish to require the market to lower levels, sanctionative them to sell high

and get low, that is nothing over shopping for low and mercantilism high backward. It is like your friend wants to sell his house for what you think to

be a good price.

He says, “I can sell you my house for $180,000. Anything you get over

that, you get to stay.” So you agree to buy his house at $180,000, providing you sell the house for more than you paid for it. The two of you agree

that you get 2 months to sell the house before you have got to really pass away

from him. As long as you sell it within two months for more than $180,000,

you are going to make a profit. All of a sudden, you find a buyer at

$220,000. Now you have to sell it to the buyer first before you buy it from

your friend. In order to create your profit and earn your cash, you now

need to sell 1st at a better worth and get second at a lower cost. In the

financial markets, this is called shorting the market, or going short, and

having the market go your way.

Here is however you sell 1st, buy second, and have the market go against

you. Let’s say that in the 2 months you’ll not sell the house,

and the market starts to crash. You panic as a result of the home is currently value solely

$160,000 and still falling, yet you are under contract to buy it for $180,000.

You decide to “dump it,” or sell for $160,000 to avoid any further loss. So you

sell it for $160,000, first, and then you buy it, second, at $180,000 and pay in

the difference. This time the market failed to go with your approach and you over up

buying high then selling low resulting in a loss of $20,000.

To avoid making losses, it is important to know how to identify those

potential targets the bears are aiming for. Past lows or major levels of support are determined by looking at the current price and then working your

way back as if you were walking down a set of stairs (see Figure 5-6).

The major levels of support are the targets the bears will be aiming

for if they are in control or want to take back control from the bulls. This

happens when the market reaches a past level of support and establishes a

new low. There are two reasons for the pullback (see Figure 5-7).

The first reason for a pullback could be the fact that traders that

take long positions most of the time place their protective stop-loss

orders near or at the last lows, meaning that when the bears hit that

price point, there are a lot of sell-stop orders and a tremendous

amount of shopping for going down, maybe a lot of shopping for than mercantilism.

Bears succumb temporarily and bulls start to gain a little territory,

and a pullback and small rally take place. As a rule, prices will

continue to rally until the bears step in and start selling again and

bulls begin to resist buying because of all the selling. Bulls resist

buying and bears start selling at one of three locations in a

downtrend:

Near a past level of resistance

Near a downtrend line

At a Fibonacci down retracement number

You may also find all three at the same numerical price point, which is

then called a convergence

2.A second reason for a pullback could be a Fibonacci down extension level, which I will discuss in Chapter 8.

If the past level of support is penetrated and the downtrend is going to hold,

the bears will step in and start selling heavily near the last high or level of

resistance. The first level of resistance becomes a great area to go short

in the market, provided you get a bearish candlestick formation near

resistance.

PAST RESISTANCE CAN BECOME FUTURE SUPPORT

As bulls and bears continually play this wicked game of greed and

fear, bulls try to make higher highs and bears try to make lower lows. As

the market moves up, again and again, past resistance becomes future

support and becomes a great place to buy, but only after a bullish

candlestick formation seems at that the majority recent past level of resistance

PAST SUPPORT CAN BECOME FUTURE RESISTANCE

As the market moves down, again and again, past support becomes future resistance and becomes a good place to sell when a

bearish candlestick formation appears at that most recent past level of support

Last But not the list

Trading is a game. It is a game played by two sides—bulls and bears—

although there aren’t actual bulls and bears, just human traders with very

different opinions. They started out just like you and me, trying to figure

out how this market works. Some have been washed out. Some are still surviving and trying to learn. Others have made it big because they believed

in their dream and stayed focused until they figured out what works. The

way to learn how to win at this game is to work at it.

You have to move forward with the determination to succeed in this

game. After all, the majority of work is done for you in this book. Experiencing success at trading will teach you how ultimately to succeed—you

just need to take the time to understand truly what is written here.

Successful traders are successful for a reason. They take the time to

educate themselves first about the opportunity, and then they calculate the

risk versus the reward. With that calculated risk, they jeopardize their personal comfort level. A setback is an opportunity to start all over again more

intelligently the second time around. Giving up along the way is the

ultimate tragedy.

After teaching thousands of people how to trade, I would have to say

the one personal characteristic I would regard as being the most important

trait necessary to succeed at this game is the trait of persistence—the determination to endure to the very end after being knocked down 100 times,

and getting back up a 101st time with a positive attitude. When you get to

a point where you think this entire market, everything and everyone

involved in it, is against you and you adamantly feel you cannot hang on,

not for even one minute longer, it is right then and there that you cannot

give up. This could be the place and time when everything turns around for

you. The trader who can persist a little longer once his or her effort

becomes painful is the trader who will find success at trading. For

some reason, pain and suffering are our teachers and they help us persist

until we can succeed.

True winners keep playing until they get good at the game and get it

right. Our greatest achievement at trading is not in losing in a trade but in

getting right back in there after something went wrong and we lost on a

trade.

This game is not as hard as it looks. We make it hard. Successful traders

will do what unsuccessful traders won’t do. With their knowledge of how

that market works, they create a clear trading strategy and a trading plan

that they will follow with non-negotiable discipline.

Trading doesn’t come naturally for anybody. Learning to trade is not like

learning a sport such as a basketball or a football. When it comes to trading,

you get good by working hard and by practicing over and over again a trading technique that you understand. Success will come by not trying to do everything.

- You must keep it simple. Do not complicate it! When you make

a mistake, remember, what doesn’t destroy you will only make you a

stronger and wiser trader

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience